Looking Back at 2020 & What’s In Store For Shareholder Activism in 2021?

A Year We Won’t Forget Lightly

To say the coronavirus pandemic had a sudden and devastating impact on our health and economic prospects during 2020 would be an understatement. The booming industry of Shareholder Activism was not spared the wrath either.

As companies all over the world tried to patch leaky holes at the infancy of the pandemic in February and March, activists chose to hit the pause button.

Many were afraid of looking like vultures against an ugly backdrop of a damaging health and economic crisis. Volatility in the share market, uncertainty about our economic future and a ‘go-slow’ approach to M&A stopped most activists in their tracks.

The slowdown in activist activity may have come as a relief for many CEOs and Boards. In fact, the first nine months of 2020 showed the number of U.S. companies publicly subjected to activist demands fell 11%, to 367.[1]

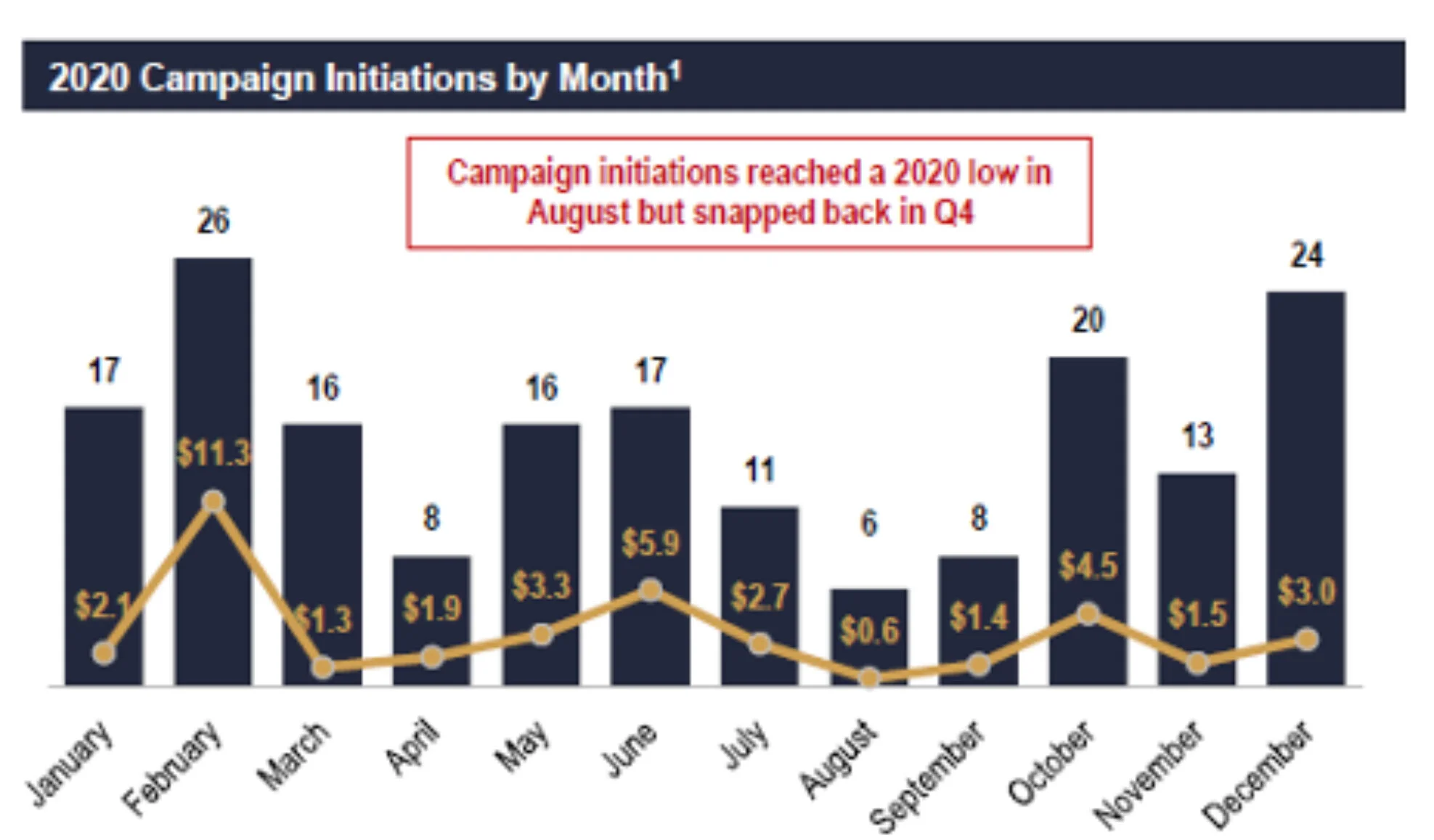

Figure 1: 2020 Global Campaign Activity and Capital Deployed ($ in billions).

Source: Lazard Shareholder Advisory Group.

But the relief didn’t last long. There were immediate signs of an uptick in activist activity once the storm settled and companies began adjusting to the crisis.

The V-bottom reversal in the stock market was most astounding. A ‘whatever it-takes’ approach from central banks helped lift share prices and put an immediate spotlight on activist portfolios in the U.S. who ‘stuck to their guns’ so to speak.

“The market’s negative response to stocks in a process of transition has since become favourable and funds that doubled down on their convictions were rewarded handsomely,” said Activist Insight in its 2020 Annual Report on shareholder activism.

Like A Bull at The Gates in 2021

We believe activists will be ready to explode into a surge of activity in 2021. Activists who did a full 180 on ambitions to launch campaigns in 2020 will now give the ‘all-clear’ on fresh campaigns. Activists can’t sit and wait forever after all. Funds who raised capital will be feeling the pressure from investors to deploy capital and show them a return too.

Who Will Be in the Crosshairs?

We see activists are focusing on companies that underperformed relative to their peers and those that showed poor judgment in response to the crisis.

Companies that continued to reward executives with generous pay packets and bonuses even as their share prices plummeted will be firmly on the radar too (a few companies that used JobKeeper payments to prop up earnings come to mind here).

Industries most likely to be in the crosshairs are those that were facing challenges before the pandemic hit, like energy and manufacturing (the ‘old’ industries). And companies that experienced a big shortfall in earnings because of the pandemic, such as entertainment and events and commercial real estate will also be a natural target.

ESG Back in Focus Too

If there was a theme for ESG in 2020, it was the ‘S’ part of ESG. It’s obvious to anyone that social issues claimed the spotlight among the public and media outlets. Social issues are the real deal in the shadow of the pandemic—especially considering the Black Lives Matter movement.

The pressure gauge will go up several notches and companies across the board will face even more pressure from activists to focus on social issues like diversity. Expect more focus on female participation at Board level and the issue of diversity among employees to be high on the list of priorities. Tokenism will no longer be excepted.

You can count on activists to step up demands on the environmental front too. This trend had a lot of salience leading up to the pandemic and will resume with fervour. Rio Tinto provided a shocking example in late 2020 of how lax ESG policies can be and the lengths a listed company will take to circumvent them.

A large sample of activists has now demonstrated the ability to go after ESG concerns. Fewer have managed to turn the movement into a working business model though and a sole focus on ESG is not going to be an objective for ASI.

The AGM and reporting season in 2021 may be a process of sorting the brains from the brawn, especially for newcomers or inexperienced activists.

Choosing the right targets, finding workable solutions, and working with boards in a constructive manner, plus a good dose of ‘street smarts’ will be more important than ever for activists heading into 2021 and beyond.